Why Every Business Demands a Trusted Bookkeeping Expert

These professionals not only aid in navigating tax guidelines and conformity problems however also give critical financial understandings that can form critical choices. By leveraging their knowledge, organizations can improve their financial efficiency and reduce possible threats.

Recognizing the Role of an Accounting Advisor

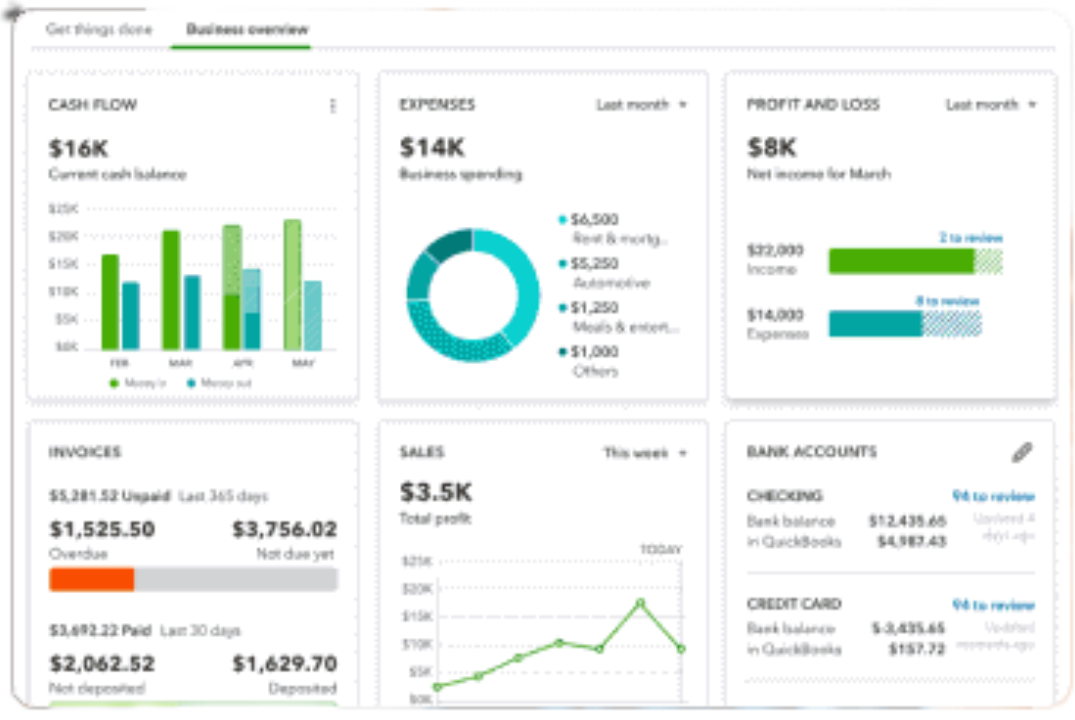

An accounting advisor acts as a critical companion for businesses, giving vital monetary support that surpasses plain number crunching. Their experience includes a wide variety of monetary matters, including tax obligation preparation, budgeting, and compliance with governing requirements. An effective accounting advisor not only prepares monetary declarations but additionally translates these records to assist in educated decision-making.

Along with standard accountancy tasks, consultants play a pivotal duty in establishing financial techniques that line up with a company's long-term objectives. They examine economic threats and chances, using understandings that assist services navigate intricate economic landscapes. By carrying out complete assessments of a firm's economic health and wellness, accounting advisors can recognize areas for renovation and potential expense financial savings.

Moreover, they act as a vital resource for understanding the effects of financial decisions, guaranteeing that businesses are equipped to make choices that foster development and stability. This joint relationship allows companies to adjust to altering market conditions and governing environments, ultimately improving their affordable edge. In essence, an accountancy expert is important to a business's economic success, delivering tailored suggestions and proactive services that drive sustainable growth.

Benefits of Expert Financial Assistance

Expert monetary advice supplies organizations a tactical advantage in browsing the intricacies of the monetary landscape. By leveraging professional understandings, firms can make educated choices that drive growth and sustainability. Among the primary benefits is enhanced monetary preparation, which enables businesses to allocate resources properly, anticipate future capital requires, and prepare for financial changes.

Additionally, professional experts provide beneficial risk administration approaches, identifying potential financial mistakes and providing services to alleviate them. This aggressive approach aids safeguard the firm's assets and makes sure long-lasting viability. Having actually a trusted advisor fosters responsibility, as they can help in setting realistic financial objectives and checking development.

Moreover, professional financial assistance help in compliance with governing requirements, lessening the risk of pricey fines and legal concerns. Advisors stay upgraded on altering laws, making certain that businesses remain in great standing - Succentrix Business Advisors. This expertise permits companies to focus on their core operations without the worry of economic unpredictabilities

Inevitably, professional monetary assistance not only enhances operational effectiveness yet also cultivates a culture of informed decision-making, equipping businesses to prosper in a competitive market.

Trick Providers Used by Advisors

Services seeking to maximize their economic health can utilize an array of key services provided by trusted audit experts. These specialists supply extensive economic preparation, allowing organizations to establish reasonable economic objectives and create workable methods to accomplish them.

One of the primary services is bookkeeping, which makes certain accurate record-keeping of all financial purchases. This foundational job is vital for reliable economic management and conformity. Advisors likewise use tax planning and preparation, assisting services browse intricate tax obligation policies while decreasing liabilities and ensuring timely filings.

Furthermore, relied on advisors provide monetary analysis and reporting, providing insights right into efficiency metrics that assist in decision-making. This consists of spending plan preparation and variance evaluation, which aid organizations track their economic health and wellness against click here for more developed benchmarks.

Additionally, advising solutions reach money flow management, guaranteeing that services preserve enough liquidity to satisfy operational needs. Some experts also concentrate on danger monitoring, identifying possible economic threats and creating techniques to minimize them.

Choosing the Right Bookkeeping Companion

Choosing the best accountancy partner can considerably affect a business's economic trajectory and overall success. A well-chosen advisor not only makes sure compliance with guidelines yet additionally gives tactical understandings that can drive growth.

When examining prospective bookkeeping companions, consider their sector expertise. An expert aware of your certain field will recognize distinct obstacles and possibilities, enabling them to customize their services effectively. Search for a firm with a proven track document of success and favorable customer testimonies.

Interaction is an additional vital element. A reliable accounting companion must come, clear, and aggressive in updating you on economic issues. Developing a solid relationship fosters cooperation and count on, which are crucial for an effective partnership.

Ultimately, choosing the appropriate bookkeeping partner calls for cautious consideration Read Full Report of their know-how, services, technological capacities, and communication design to ensure alignment with your business objectives.

Long-Term Worth of Bookkeeping Support

Spending in long-term accountancy support can yield significant benefits that prolong beyond plain conformity. A trusted accounting advisor not just makes sure adherence to laws yet additionally supplies calculated understandings that promote service development. By maintaining accurate financial documents and supplying prompt recommendations, accountants can assist organizations maximize and recognize cost-saving opportunities resource allotment.

Furthermore, a solid bookkeeping partnership boosts financial projecting and budgeting, enabling companies to make educated decisions based upon real-time data. This aggressive method can dramatically boost cash money flow management, ultimately bring about increased success. Moreover, long-term accountancy support builds a foundation of depend on and reliability, which is essential for browsing economic obstacles and confiscating market opportunities.

Gradually, the worth of having a specialized audit advisor comes to be evident as they create a deep understanding of the company's one-of-a-kind requirements and objectives. This partnership helps with customized strategies that straighten with the firm's vision, guaranteeing lasting development. In a significantly complex monetary landscape, companies that focus on long-term accounting assistance position themselves for success, getting an affordable edge through notified decision-making and durable financial health.

Verdict

Such specialists give very useful economic guidance, making sure conformity and enhancing efficiency. By using tailored approaches and translating intricate monetary information, bookkeeping experts help with educated decision-making and danger reduction.

An audit advisor serves as a critical companion for organizations, offering crucial financial advice that goes beyond plain number crunching. They analyze financial threats and opportunities, supplying understandings that aid companies browse complex economic landscapes. Succentrix Business Advisors. In essence, a bookkeeping expert is essential to an organization's financial success, supplying tailored advice and aggressive options that drive lasting growth

Professional economic assistance uses businesses a strategic benefit in navigating the complexities of the financial landscape. In a progressively intricate monetary landscape, services that focus on lasting bookkeeping support setting themselves a fantastic read for success, obtaining a competitive side via educated decision-making and robust financial wellness.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!